Robotic process automation is penetrating deeper and deeper into all areas of our life every day. Want to know how to use RPA in finance? Artificial intelligence will not soon supplant accountants and financiers, and, most likely, never. But routine tasks can be entrusted to a computer. RPA (robotic process automation) should be assessed individually by each company. In some cases, it is cheaper to leave things as they are, while in others it is better to modernize business processes.

Examples of using RPA automation in finance and accounting

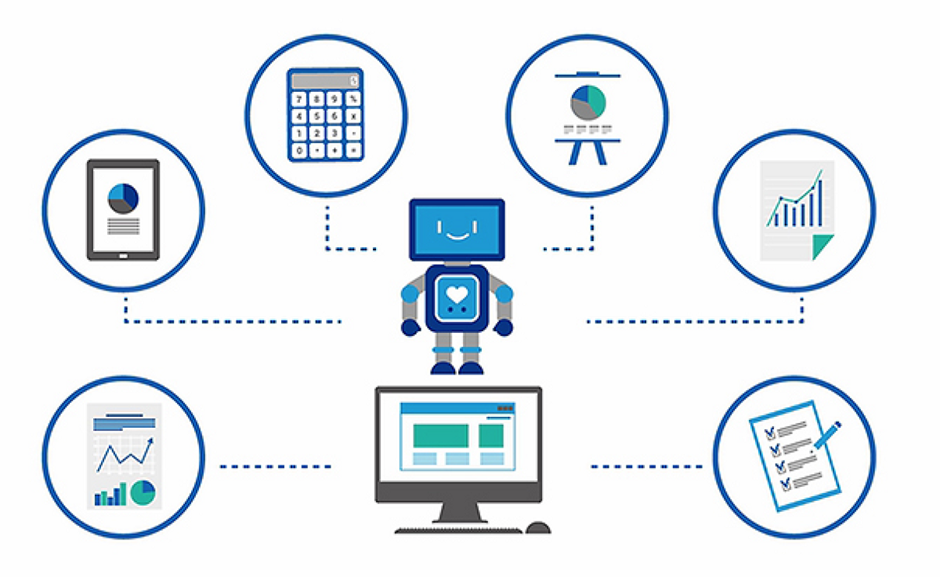

Robotic automation does an excellent job with the following tasks:

- Automation of accounts receivable accounting.

- Automation of accounts payable accounting.

- Automation of customer due diligence processes.

- Financial reconciliations.

What else can software do instead of a real employee?

To determine the profitability of modernization, you need to compare the salary of a specialist who performs routine tasks and the cost of writing and maintaining specialized software. So try to find a custom software development company which would be able to help you with appropriate IT solutions. Many companies have already automated such actions as:

- Uploading data (bank statements and subaccount balances) from various sources to internal systems and submitting reports in a pre-approved format.

- Uploading bank statements for user accounts.

- Checking balances and transactions and reconciling information with user accounts.

- Creation and tracking of data in the ledger.

Notice of any inaccuracies

RPA technology has today become a self-sufficient tool for increasing the efficiency of companies, but its true potential can only be unleashed in conjunction with other IT systems. A great future lies in the joint application of RPA technology with artificial intelligence and machine learning technologies. For example, there is already positive experience with software robots that use natural language processing methods to solve automation problems.

One of the main issues arising in the process of large-scale RPA implementations concerns information security. Companies want to have confidence in the security of technology and are committed to protecting against potential cyber threats. The main risks in the implementation of software robots are due to a feature of the technology – the ability to emulate human actions in information systems. To ensure the safety of robots, it was necessary to determine the following:

- How to distinguish human actions in a system from operations performed by a robot;

- How to organize interaction between the robot developer and the owner of the business process in the event of failures;

- Who is the greatest threat in a robotic process, a person or a robot.

A good example is software robots for integrating an enterprise ERP system with IT systems through a web user interface. These can be web client applications from 20 or more third-party companies. Banks, suppliers, consumers, reporting systems, analytical agencies and news portals are linked together in one common system.

Findings

The processes that the RPA robots performed were not, in fact, affected by the pandemic. And, of course, the move to teleworking has given current customers and robot owners an incentive to immerse themselves in the technology even further, as well as attracting new potential customers.

Most of the growth will come from expanding existing capacity. Most likely, there will be a need to release new licenses to run robotic automation software on additional servers, new processors to handle the load, and so on.